What Do You Need To Know?

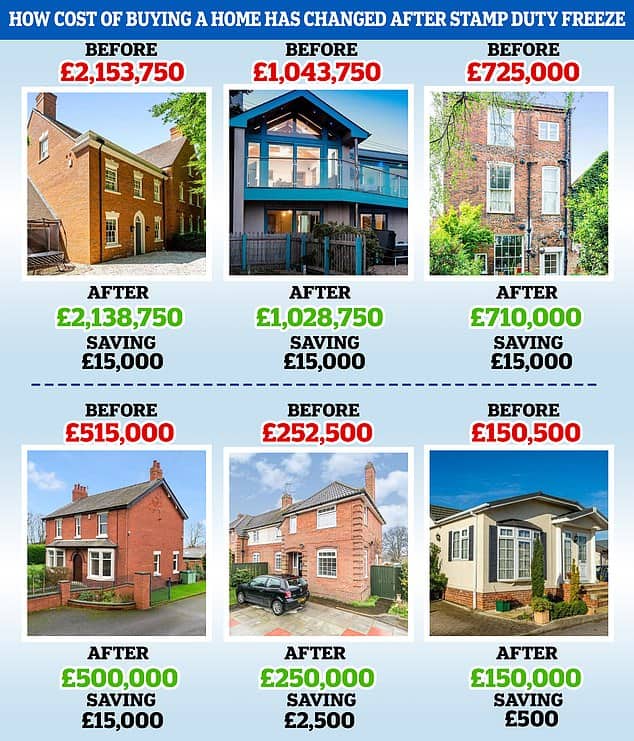

Rishi Sunak unveils stamp duty freeze on homes worth half-a-million pounds or less – as buyers delight at extra cash to spruce up their new properties thanks to savings of up to £15,000

- Chancellor Rishi Sunak has scrapped stamp duty on most homes on Wednesday

- The move is part of his mini-Budget designed to boost the growth and jobs

- The axe could save buyers thousands

Home buyers’ have reacted with joy at Rishi Sunak‘s announcement in today’s mini-budget that he will freeze stamp duty.

The Chancellor said he would immediately raise the threshold on stamp duty to £500,000 until March 31 2021.

The measure, which temporarily increases the ‘nil rate’ band of stamp duty from £125,000 to £500,000, will reduce the average stamp duty bill for the main home from £4,500 to zero. Buyers can potentially save up to £15,000.

If you buy a property over £500,000 amount, then you can still save money and can take off £15,000 that you would have paid prior to the announcement.

Property experts said the step could encourage some ‘missing movers’ back to the market.

On the housing market, Mr Sunak said property transactions fell by 50 per cent in May and house prices have fallen for the first time in eight years.

He announced he has decided to cut stamp duty, telling the Commons: ‘Right now, there is no stamp duty on transactions below £125,000.

‘Today, I am increasing the threshold to £500,000. This will be a temporary cut running until March 31 2021 – and, as is always the case, these changes to stamp duty will take effect immediately.

‘The average stamp duty bill will fall by £4,500 for people planning on selling their homes and for those planning on moving the property market is suddenly looking brighter. And nearly nine out of 10 people buying a main home this year, will pay no stamp duty at all.’

Buy-to-let investors and people looking to purchase a second home will also benefit from the changes announced by the Chancellor today.

Did The Stamp Duty Holiday Work?

Considering that the property prices are affected by various factors such as the country’s economy, supply and demand, mortgage rates, affordability and more it is hard to clearly say the impact the stamp duty holiday has had on the market. Although, all available data indicates that the stamp duty holiday has significantly affected the property market in a positive way. Estate agents across England have reported record enquiries, with 1.3 million homes sold and prices not experiencing such a fast rise in the last 17 years.

How The Stamp Duty Holiday Affected The House Prices?

The fact that people could save thousands of pounds has made many to move into a larger home and exploit this unique opportunity. As a result, the demand for houses has significantly increased which meant a rapid and substantial growth in house prices. According to analysts, house prices have seen a steep increase of 13.4% in June 2021 – the highest growth in 17 years. However, this was not the end of the growth. According to Halifax, the house price index in the UK has seen an astonishing 10.5% YoY growth in May 2022.

How Does The End of Stamp Duty Holiday Will Affect Home Movers?

So now that the stamp duty holiday extension has come to an end people will have to accept and go back to ‘normality’ how it was pre-pandemic. People have had the chance to save up to £15,000 which could have been used for any provisional storage solutions. Or even getting a new kitchen, updating the bathroom or covering some of the home removal costs. Considering that people will have to now pay extra to the government, they should seek options on how to save a little bit of cash. A good start would be to find an affordable house moving service and start using an app that can help save money on day-to-day spending.

What Will Happen To The House Market After The Stamp Duty Holiday?

Despite the extra costs home movers have to pay, the market is still booming, however, economists claim that a price correction might be just around the corner. After a price correction, there are two possibilities, either further growth or a drop. Considering the current economic climate such as the after-effects of Brexit, pandemic-caused chaos and the war in Eastern Europe, the housing market may turn to be bearish rather than bullish.

Will There Be a Stamp Duty Holiday in 2023?

The chances for another stamp duty holiday to be introduced in 2023 are very low. However, many experts claim that after the price correction predicted in the second half of this year, house prices are expected to fall. According to the latest research, there is a 5% drop is expected at house prices by the end of 2024, which could save some cash in a different way. If people make smart decisions and sell and buy their homes at the right time it could save them significant cash.

How To Save Money After Stamp Duty Holiday Ends?

Now that talking about savings there are other ways to save some cash while using other services when moving homes. It is worthwhile to consider the prices of garden maintenance, waste removal services, house cleaning and house clearances as these can save significant cash for the households.